Credit Reports and Credit Score

What is a Credit Report?

A credit report, or credit file disclosure, is a record of your credit activities. Your credit is very important in determining how much you can borrow, the interest rate and the terms. With your permission, it may even be considered by potential employers.

In 1971, the federal government passed the Fair Credit Reporting Act (FCRA), which provides basic rights to all consumers and recognizes the need for all credit information to be correct. The Federal Trade Commission (FTC) enforces the FCRA.

The three main national credit bureaus are Equifax, Experian and TransUnion. All of your creditors will report your information to at least one of these agencies, and your credit report is continually updated.

Your credit report cannot be viewed by anyone who does not have a legitimate need for viewing it. Credit bureaus can provide information only to the following requestors:

- Creditors who are considering granting or who have granted you credit

- Employers considering you for employment, promotion, reassignment or retention

- Insurers considering you for an insurance policy or renewing an existing policy

- Government agencies reviewing your financial status for benefits

- Anyone with a legitimate business need for the information, such as potential landlords

What is a Credit Score?

Your credit score and your credit report are two different things. A credit report is information about your credit activity. A credit score, or FICO®(Fair Isaac and Company) score, is calculated based upon the information in your credit report. FICO® scores range from 300 to 850, with a higher number indicating a better credit score.

Lenders use this credit score to evaluate your creditworthiness, or your ability to repay a loan. A higher score means you are a lower credit risk, so companies will charge you less to borrow money. You can obtain your score from the credit bureaus, usually for a small fee. Learn more about credit scores by downloading the booklet Understanding Your FICO Score or by visiting www.myfico.com

What factors make up your Credit Score?

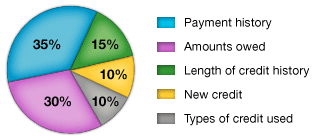

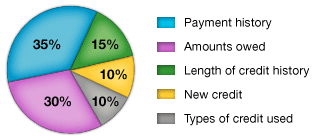

There are essentially five categories of information that comprises your credit score. Chart provided by myfico.com

The most important factor is your payment history - that is, if you pay your bills in a timely manner. Late payments, collections actions and bankruptcy filings have a very negative impact on your credit score.

The amounts owed is the next largest factor in determining your score. Both the amount of debt you are carrying and the credit to debt ratio are taken into consideration. If you are maxed out on a credit card, or close to it, that could count against you. Owing $2900 on a credit card with a $3000 limit will impact your credit score more negatively than carrying a $2900 balance on a credit card with a $5000 line of credit.

Credit bureaus also consider the age of your credit accounts, whereby the older the account the better it is for your score. For that reason, it is not always a good idea to cancel an account once you have paid off the balance in full. If you have had that credit card for awhile, you might want to just cut up the card but leave the account open.

Every time you apply for a credit card or loan the creditor or financial institution requests to see a copy of your credit report. Each such request is considered an "inquiry". Too many inquiries can hurt your credit score.

Another factor that plays into your credit score is account diversity, or the types of credit in use. Having both "installment loans" (e.g. mortgages, car loans, etc.) and "revolving credit" (e.g. credit cards) helps your score.

The below chart is a useful guide in identifying the factors resulting in a credit score within a particular range:

| If you have … |

Your Credit Score range will be… |

This Credit Score is … | The level of interest rates for which you would be eligible… | |||

|---|---|---|---|---|---|---|

| Late payments, collections, public records |

Credit utilization (balance/limit ratio) |

Length of credit history | New accounts & Inquiries | |||

| None | 1% – 10% | Long | None | 800+ | Excellent | Lowest |

| None | 1% – 10% | Medium to long | Very few | 750-800 | Very good | Lowest |

| None recently | 10% – 25% | Medium | Few | 700-750 | Good | Low to medium |

| Recently, but not currently | 25% – 50% | Short to medium | More than a few | 650-700 | Fair | Low to medium |

| Currently and in the past | 50% – 75% | Short | Too many | 600-650 | Bad | Medium to high |

| Currently and in the past | 75% – 100%+ | Short | Too many | Below 600 | Very bad | High |

Your Free Reports

Under federal law, consumers can receive one free copy of your credit report every 12 months from each of the three credit reporting agencies (Equifax, Experian, and TransUnion). Plus, as a Georgia resident, you are entitled by the Fair Business Practices Act to receive two additional free credit reports from each credit reporting agency per year.

To order your free credit reports, go to AnnualCreditReport.com or call 1-877-322-8228.

To request the second and third free credit reports you must contact the three credit reporting agencies directly.

Please note that because of the financial impact of the COVID-19 pandemic, the three credit reporting agencies are now offering free weekly credit reports through December 31, 2022.

How to Contact the Credit Bureaus

| Contact | Phone |

|---|---|

| Equifax Credit Information Services, Inc. |

|

| Experian National Consumer Assistance Center |

|

| TransUnion Consumer Relations |

|

The credit bureaus may vary in their method of providing your additional free credit report(s), and the report you receive from one of the bureaus (as well as your credit score) could be different from the others. Each collects its own data, and they do not necessarily receive the same information from your creditors. It is important to review your credit report from each bureau to ensure that the information is accurate and there is no fraudulent activity attributed to you.

Send complaints about any of the credit bureaus to the FTC.

If you are denied credit on the basis of information in a credit report, you may get a free copy of your report from the credit bureau that supplied the initial report. If you are the victim of identity theft, you can call any one of the three credit-reporting agencies to request that a fraud alert be placed on all three of your files and that a copy of each current report be sent to you.

Information on Your Credit Report

Credit bureaus collect many types of information about you. This includes where you live, where you work, how you pay your bills, and whether you have been sued or arrested or have filed for bankruptcy. The four basic types of information collected are:

- Your identification and employment information:

- Name

- Social Security number

- Date of birth

- Current and previous addresses

- Telephone number

- Current and previous employers

- Payment History: All of the credit accounts, including mortgage, credit card, retail credit cards, bank and finance loans, that you have had within the past 10 years appear on your credit report. The collected information includes:

- Your name and account number

- Date account was opened or closed

- Amount borrowed and amount still owed

- Credit limit

- Timeliness of payments

- Inquiries: A list of organizations that have requested your credit report other than you, including lenders within the past year and potential employers within the past two years.

- Public Record Information:

- Bankruptcies

- Foreclosures

- Judgments, including child support judgments

- Tax liens

- Criminal convictions

Most of this information, as well as information on your various credit accounts, will be on your report for seven years. Personal bankruptcies will be reported for 10 years.

No one can remove correct information from your report, even if it is negative. Con artists will tell you that they can remove negative information on your credit report for a fee, but only the passage of time will achieve that result.

Common Errors on Your Credit Report

Since credit information is collected from a variety of sources, errors do occur. Check your credit reports periodically and address errors immediately. Serious errors could affect your ability to obtain a loan, insurance or even a job or could affect your credit rating, which in turn would mean that you might have to pay a higher interest rate when you borrow money.

- Information about you

- Look for misspellings of your name or errors in your birthdate or Social Security number.

- Make sure the same loan is not listed more than once.

- Look for omissions, such as the fact that you paid off a delinquent account or resolved a legal matter.

- Make sure accounts that are closed are actually listed as closed.

- Information that is on the report that is not about you

- Look for "mixed" information, such as information about Robert Johnson, Sr. on the report for Robert Johnson, Jr.

- Information about you that is very old and should be removed

- Look for old addresses, employers or a previous spouse's information.

If you find errors on your report, you can dispute them at no cost. Details on how to dispute an error are included with your credit report, but basically you should notify in writing the consumer credit reporting company (Experian, Equifax or TransUnion) as well as the person or company who provided the information of the error. Be as detailed as possible, providing copies of documents as needed. Send your letters certified mail, return receipt requested and keep a copy for your records.

The consumer credit reporting company must investigate your allegations within 30 days and will notify you of the result. More information on this dispute process, as well as a sample dispute letter, is available through the FTC.

Getting a Credit Report on Behalf of Someone Else

A parent or guardian of a minor child who needs to get a credit report on behalf of their child may need to submit a

Uniform

Minor’s Status Declaration

and provide additional documents establishing he or she is the minor’s legal guardian.

If you are the designated or court appointed guardian of an elderly person or a dependent adult, you may write the three credit reporting agencies on behalf of the person in your legal care. When you write the agencies to request their credit report or dispute information on their report, you should include in your letter:

- The senior family member/dependent adult’s full name and social security number;

- Your name, address, and relationship to the senior family member or dependent adult;

- Documentation showing that you have legal responsibility for the senior person/dependent adult.

How to Raise Your Credit Score Legitimately

- Inspect your credit report and correct any errors. A study conducted by the National Association of State PIRGs found that of the credit reports surveyed, 79% had general errors and 25% contained serious errors that could have resulted in the denial of credit.

- Own credit cards and manage them responsibly.

- Avoid doing the things that lower your credit score.

-

Many scoring models compare the amount of debt you have to your credit limits. The closer the numbers, the more negative the impact is upon your credit score.

-

A short credit history may have a negative effect on your score.

-

Application for too many new accounts in a short time can negatively impact your score.

-

- Pay on time. Late payments hurt your score more than anything, except not paying at all or bankruptcy.

- Pay more than the minimum due each month.

- Apply for credit only when you need it. New accounts could lower your score by lowering the average age of all your accounts, and even closed accounts may be factored into your score.

Fraudulent Credit Report Websites

Have you ever received an unsolicited e-mail or an Internet pop-up ad offering free credit reports? Be careful. Many of these online operators are using such offers to collect your personal information and use your identity for fraudulent activities. Here are a few words to the wise:

- There is only one source for your free credit reports - www.annualcreditreport.com. You can make your request on-line, by phone or by mail. Avoid all other websites no matter how good the offer seems to be.

- If you get an e-mail offering a free credit report, call the company instead of clicking the link.

- Be skeptical of unsolicited e-mails offering a free credit report, especially from unusual e-mail addresses that have numbers, misspelled words or a foreign domain.

- Verify the company’s name, address and telephone number.

- Signs of a scam include misspellings or grammatical errors in the letter, or an area code that does not match the zip code of the company.

- Search Network Solutions online to determine who owns the web site.

- Legitimate companies will not ask for your personal identification number (PIN) for your bank account, your passport number, or the three-digit number on the back of your credit card.

- Only use secure websites when providing any personal information online. A secure site will have “https” at the beginning of the web address.

- Always check credit card statements for any unauthorized charges.

If you have been a victim of this type of scam, please let us know.

You may also file a complaint with the FTC by going to reportfraud.ftc.gov or calling. Due to the number of complaints they receive, they cannot treat your case individually; but they may use your information for purposes of a national investigation.